Will Planning: The Benefits of Having a Will and How to Get the Process Started

Having a Last Will & Testament

A Last Will and Testament is one of the most important estate planning documents that you can put in place to ensure that your wishes and intentions are clearly documented.

A Will allows you to specify the person or persons you wish to manage your estate, in what manner, who your beneficiaries are and how they will benefit, whether you wish to appoint a legal guardian for your minor child or children, as well as other arrangements that you wish to be executed after your death.

By legally documenting your wishes, you can provide your loved ones and trusted advisors with the clarity they need to properly organise and appropriate your assets. Putting a will in place can bring with it, a number of useful benefits. In this blog, we will discuss how to get the will planning process started and some of the advantages of having your wishes documented in a will.

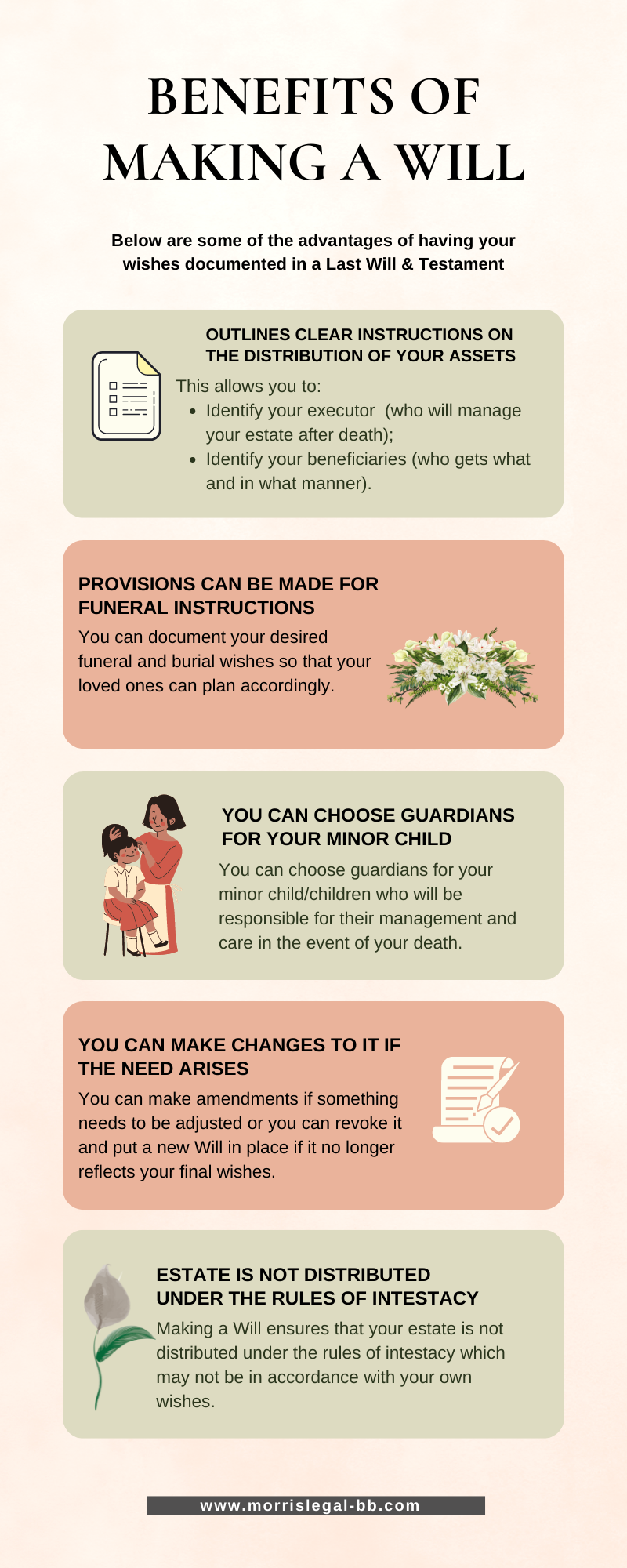

Benefits of Having a Will

It allows you to outline clear instructions on how you wish to distribute your assets

You can identify trusted individuals to distribute or manage your estate

You have the ability to identify your beneficiaries and specify who gets what

You can choose guardians for your minor child or children

You can make provisions for your funeral instructions

It allows for peace of mind by making it easy for your loved ones to know your wishes and plan accordingly

You can make amendments if something needs to be adjusted due to a change in circumstances or you can revoke it and put a new will in place if it no longer reflects your final wishes

Having a will prevents your estate from being distributed under the rules of intestacy which may not be in accordance with your own wishes

Now that we have identified the benefits of putting a will in place, here are some of the ways that you can get started with the will planning process.

Getting Started with the Will Planning Process

1. Create an inventory of your assets and liabilities

Begin to document the following:

Real property (homes, commercial property, land, etc.)

Personal property (savings, investments, jewellery, memorobilia, family heirlooms, and other personal property

Liabilities (mortgages, loans, bills, credit cards)

2. Identify your executor

The executor’s role is to manage your estate after your death and to be responsible for ensuring that your wishes are executed after your death. Identify an individual or individuals who will be designated to handle your estate. It is recommended that you notify this person so as to determine if they will be in a position to take on this role. It will also be prudent to provide them will details on how they can locate key documentation or readily have access to important information.

3. Appoint Guardians for Minor Child or Children

If you have a minor child or minor children, make a list of individuals that you would want to be responsible for the rearing of your child or children. This may a close relative or friend.

These persons may be selected based on specific values, backgrounds, parenting styles that you believe this person can be entrusted to fulfil in the event of something happening to you.

Provide the individual with useful information about the minor and advise about the relevant documentation as to his or her appointment

4. Identify your Beneficiaries

Once you have determined your assets and what you wish to pass on, identify who will be the recipient of these assets

Determine whether the assets will be distributed to one individual, multiple individuals or whether certain assets will be distributed jointly or solely. Remember you get to decide.

Also make provisions for your residuary estate, that is, determine how your property will be distributed in the event that certain assets are not accounted for, or in the event that the beneficiary is unable to receive the gift, whether by death or otherwise

5. Provide funeral instructions

Though optional, you may also wish to decide your plans for your funeral or memorial service.

You can document how you wish your body to be disposed whether by way of burial, cremation or otherwise

You can also specify who should be the funeral director, who will lead the ceremony, the music arrangements and so on

If you plan to make a deposit on your funeral arrangements, or already have, it is important that you document this and inform your proposed executor or a trusted individual, so that your loved ones are able to execute your funeral plans or memorial service in accordance with your wishes.

Final Note

By putting a will in place, you get the opportunity to document who will benefit from your estate and in what manner. You will also be in position to provide clear details on who will be in charge of handling your estate as well as how it will be managed. Without leaving a will, your estate will be passed under the rules of intestacy. As such, the court will distribute your estate in accordance with these rules, which may not be in keeping with your own personal wishes.

Also of important note is that you should from time to time, review and update your will as required, taking into account any significant changes that occur in your life.

Ultimately, having a will prepared allows for your loved ones to have peace of mind, knowing that you have organized your affairs and put things in place for them to have a smooth transition when administering your estate. This allows your loved ones to stay out of conflict and disputes, as they will have the clarity they need to administer your estate in accordance with your wishes.

Questions?

Thank you for taking the time to learn more about the benefits of a will and the will planning process. If you are a seeking to have your Last Will and Testament put in place, and require further guidance on the process, our office would be delighted to speak with you about your particular concerns. To find out if we can be of assistance, kindly contact us our office by clicking here.

Here are some other helpful resources to help you get started: