Does Your Estate Plan Need to Be Updated? Reasons To Review Your Estate Plan Right Now

Reviewing Your Estate Plan

Perhaps you have already started to put estate planning documents in place to protect your loved ones and your legacy. However, estate planning should not be seen as a ‘set it and forget it’ process. As time goes by, the circumstances of your life may evolve overtime.

This therefore means that as long as you have estate planning documents in place, you may need to revisit them when significant events occur in your life, or in cases where you have simply changed your mind about who should inherit your property or who should be in charge of managing your estate.

In this article, we will share a scenario which addresses some common life events that can take place after making a Will. We will then delve into some of the reasons why you may consider updating your estate plan.

Let’s take a look at the following scenario.

Janice is a 59-year-old nurse who is approaching retirement. She is now a widow, as her life partner and husband Ray passed away just 5 years ago due to complications with heart disease. Janice and Ray built a beautiful life together and owned a lovely home in St. Peter, Barbados which they owned as joint tenants. Together, Janice and Ray raised two bright, ambitious children, Sarah, aged 36 and Ronald, aged 31. Sarah has one daughter, Hailey, aged 11 years, Janice’s only grand-child at the moment. Recently, Ronald and his wife announced that they will be expecting their first child in a few months, and Janice is thrilled about welcoming her second grandchild into the family.

Here’s a look at Janice’s Last Will & Testament.

Some 9 years ago Janice first started the estate planning process at age 50 and had her Will prepared so that she could legally document her final wishes. Since then, Janice has not revisited her Will.

In her Will, she appointed her husband Ray as the sole executor under her Will. She left her motor car and investments to her husband. She also left some funds for her two children Sarah and Ronald. In the Will, it states that all her jewellery would be given to her grandchild.

Since the making of Janice’s Will, some significant life events have occurred in her life, including the death of her husband Ray. She is approaching her retirement and she is also expecting the birth of a second grandchild very soon.

We will now consider some of the things that can be revisited under Janice’s Will to ensure that her ultimate wishes are carried out.

Updating The Name Of The Executor

After making a Will, you have the option to change the chosen executor under the Will, whether due to illness or death of the executor, or where you have simply changed your mind for some reason.

In Janice’s Last Will & Testament, her husband was named as the sole executor of her Will. Since he is now deceased, Janice should update her Will to include a new executor or new executors if she chooses to appoint more than one.

Death of A Beneficiary

Where there is a death of a beneficiary, this will be a critical time to update your Will.

In this case, one of Janice’s beneficiaries was her late husband, to whom she left her motor car and investments. However, since he has passed away, Janice may update her Will to appoint a new beneficiary of these assets. If she fails to do so, these assets would be passed under the rules of intestacy as outlined in this article here.

Changes in How Much Property Is Owned

Where your assets have been significantly increased or reduced, this will also be an important time to make an adjustment to your Will. This is critical so that your Will reflects your present circumstances.

In Janice’s case, she previously owned her home in St. Peter, Barbados as a joint tenant with her husband. Since her husband died, ownership of the property automatically passes to her by the ‘right of survivorship’ principle for joint tenants.

Since Janice is now the sole owner of the property, this means that she has the option to adjust her Will and may choose to distribute her real estate property according to her own wishes.

Janice is also approaching retirement. If she has a retirement plan, she may wish to adjust any beneficiaries, depending on her particular preferences and circumstances. The beneficiary chosen will be the person who receives the retirement benefits after she dies.

Janice has also provided a gift of money to her two children. If there has been any change to the amount of funds she currently has, she may adjust her Will accordingly to reflect this.

Additional Family Members

Where there has been an expansion to your family, this may also be an appropriate time to change your Will. The reason for this is that you may want to pass on a portion of your property to a new person in mind. This may arise where there is a new baby in the family or a new partner.

In Janice’s case, she is expecting the birth of a new grandchild. In her present Will, she has named her current grandchild as a beneficiary of all her jewellery.

Because Janice has only stated ‘grandchild’ this may lend some confusion as to which grandchild she is referring to. Janice may therefore wish to insert the name of her grandchild in the Will. She also has the option to make adjustments to her Will so that it includes provisions that will reflect any future grandchildren that she has, if this is a preference of hers.

Final Thoughts On Giving Your Estate Plan a Check-up

Like Janice, you may have already created your Will, but may have encountered a number of changes in your life since then. It is critical that your estate plan accurately reflects your current situation so as to avoid any conflict and to make sure that your wishes are ultimately carried out.

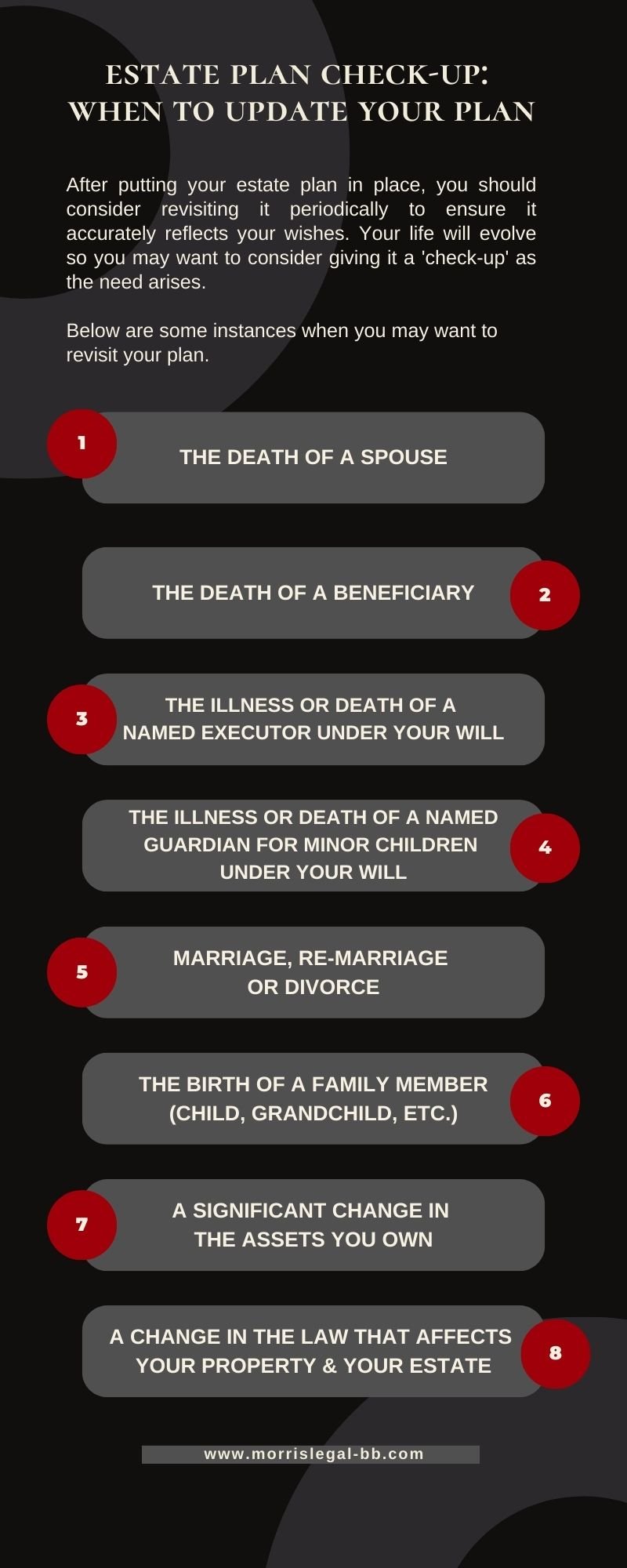

Some common instances where you may want to consider revisiting and updating your estate plan are as follows:

The death of a spouse

The death of a beneficiary

The illness or death of a named executor under your Will

The illness of death of a named guardian for your minor child or children under your Will

You get married, re-married or get a divorce

The birth of a family member (e.g: a child, grandchild, etc.)

There is a change in how much property you own (it increases or decreases)

There is a change in the law affecting your property and your estate.

Final Note

Under Barbadian law, changes to your will made be made in either of the following ways:

Putting a Codicil in place – this is typically used where the change you wish to make is minor. This will be added to the original will; or

Revoking your Will and making a new one – this will involve making a declaration that you intend to revoke the previous Will. This is generally done when there are extensive changes to be made; or

Revocation by operation of law – a Will would be automatically revoked by a subsequent marriage of the person making the Will unless it can be shown that the Will was made in contemplation of that marriage.

Before making changes to your estate plan, it’s important that you consult with an attorney about the most effective way to do this.

Questions?

Interested in learning more about how you can make changes to your estate plan to protect you and your loved ones? To learn more about what options may be available to you, you can reach out to us to discuss your particular needs by clicking here.